Experts Call for Regulation of Predatory Loan Market by Non-Banking Institutions to Strengthen Consumer Protection.

Esmeralda Topi

Fourteen years ago, Valbona Elezaj co-signed a loan for her husband and his colleague, who borrowed 100,000 ALL (Albanian LEK) from a non-banking institution in Kukës. They needed the money for materials, agreeing to pay the monthly installments in turn.

‘After paying the first three installments, we had some extra money and paid off an additional 70,000 ALL. There were 25,000 ALL left to pay, which my husband’s friend was supposed to cover. But he didn’t, and the burden fell on me,’ Valbona recalled to Faktoje.

Despite the years that have passed, she still feels anxious about the threats she received from bailiffs at the time.

‘I was living with my brother-in-law, at their house. They threatened us, saying they would take our TV, take this, take that… Every time they knocked on the door, I got stressed because I was disturbing them too. ‘If they come again, you’re the one who has to go out and deal with them,’ my brother-in-law would say,’ Valbona remembered.

Valbona’s story is not unique. Data collected by Faktoje through an online survey from dozens of citizens reveal that while taking a loan from non-banking institutions provides a quick solution, it often results in heavy financial burdens that persist for years for borrowers.

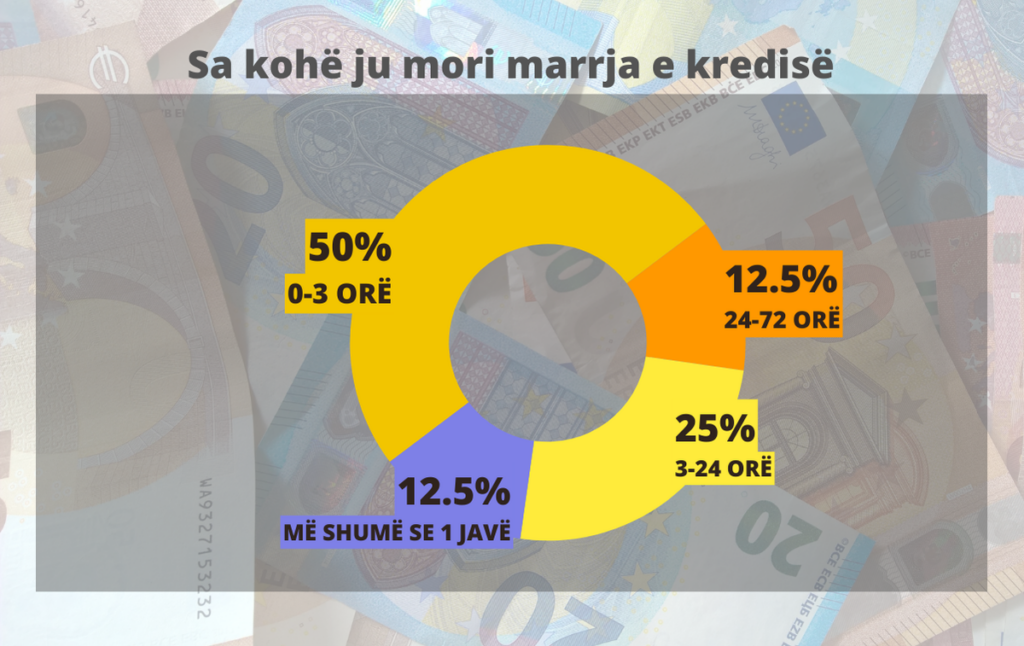

Half of the respondents who obtained a loan from these types of institutions claim they received it in less than three hours. 25% of them say they managed to get the loan within 24 hours, 12.5% of the respondents highlight that it took one to two days, and an equal percentage state that the process took more than a week. Experts claim that the functioning of non-banking institutions in the country is opaque, and their lending practices urgently need legal reform.

Experts claim that the functioning of non-banking institutions in the country is opaque, and their lending practices urgently need legal reform.

‘The only urgent legal adjustments needed, possibly even with retroactive effect, concern the way these loans are obtained,’ says Zef Preçi, director of the Albanian Center for Economic Research.

‘I mean, it’s claimed that getting the loan takes just 13.9 minutes digitally, but repaying it can lead to liquidating family assets,’ he added.

Professor Selami Xhepa, former Head of the Research Department at the Bank of Albania, also deems it essential to legally regulate non-banking institutions.

‘The way they operate should follow transparency standards similar to those of other financial institutions, like banks,’ said Selami Xhepa, an economic expert.

‘Above all, protecting the interests of clients and citizens requires new regulations, not just for microcredit institutions, but also for banks and the entire financial industry,’ Xhepa added.

Predatory Lending

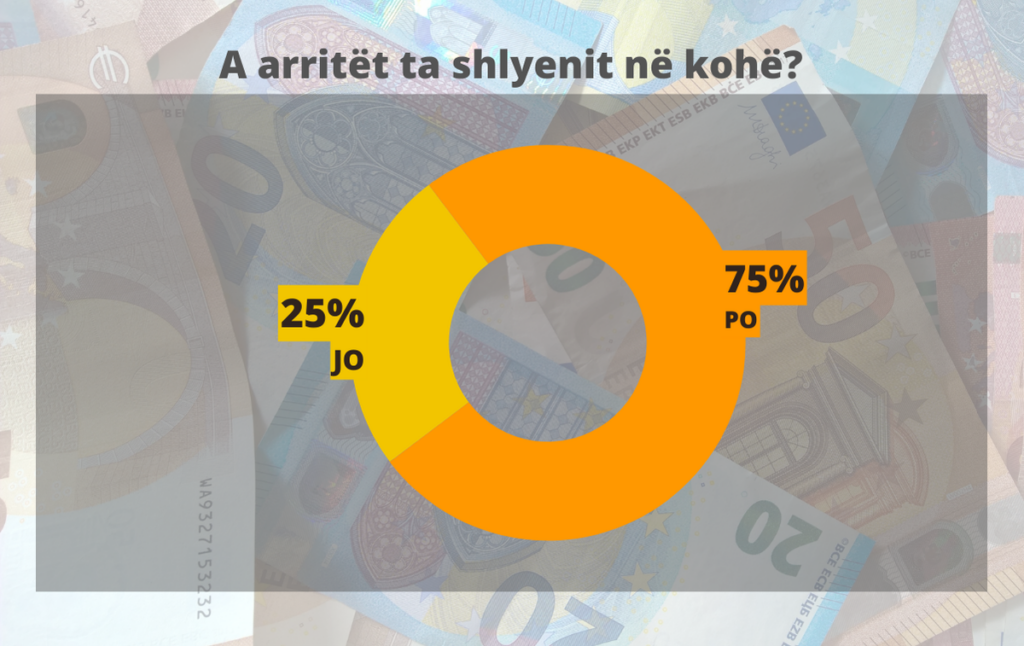

According to survey data, 75% of citizens have repaid their loans, while 25% of respondents state that they have been unable to repay their debts due to financial difficulties.

Failure to repay debts on time has severely impacted some citizens. According to the investigative file from the Tirana Prosecutor’s Office, the impact has been even more severe for others.

Two months ago, the Prosecutor’s Office announced the initiation of criminal proceedings for ‘Fraudulent and Pyramid Schemes’ against entities such as Micro Credit Albania, ADCA, SHP Zig, FS, FLASH, and their associated bailiffs.

The Tirana Prosecutor’s Office revealed that these companies employed a coercive lending scheme, whereby they forced debtors with existing bank loans to take out new loans, despite their inability to repay. This resulted in debt enforcement companies seizing the debtors’ wages, properties, and vehicles.

This scheme was used against various borrowers, leading to the theft of their assets. As a result of the investigation, the Prosecutor’s Office seized €10 million from the bank accounts of the administrators of these financial entities.

Another investigation by the Prosecutor’s Office revealed how citizens were unknowingly defrauded, with employees of Besa Fund and a notary embezzling their money.

In collaboration with one another, these individuals used deceit and abuse of trust to misappropriate loan amounts from 11 people who filed criminal complaints, defrauding them and embezzling the monetary sums.

Former Finance Minister Arben Malaj asserts that the practice of high-interest quick loans must be legally regulated. He cites the creation of the Deposit Insurance Agency following the 1997 pyramid schemes as a precedent.

‘Following the emergence of ‘predatory’ lending, a legal and institutional framework must be established to protect borrowers from these practices. The common solution is the protection of financial service consumers.’ – Arben Malaj, former Minister of Finance.

Abuse of Microloans

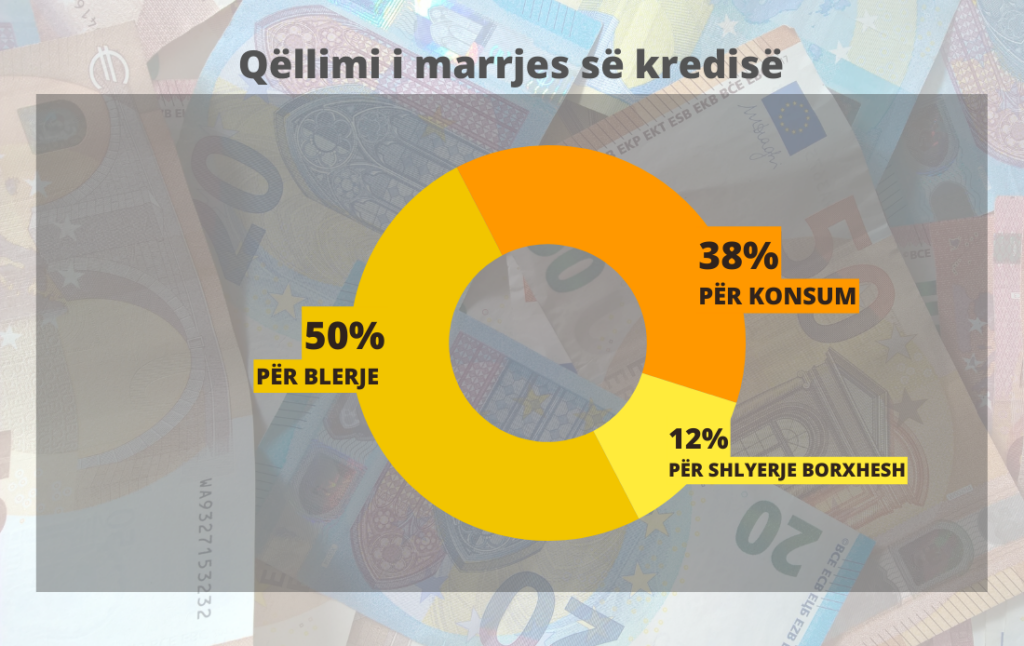

According to a Faktoje survey on the risks of quick loans, half of the respondents obtained loans for various purchases. 38% stated that the purpose of the loan was for consumption, while 12% took out loans to repay other debts.

Lavdosh Gjoka from Vlora acted as a guarantor for a person who had taken a 300,000 ALL loan for home appliances. The borrower defaulted on 30,000 ALL. When the execution order was issued, debt collection agencies did not pursue the primary debtor but targeted Lavdosh instead.

“After obtaining information on Lavdosh, they ignored the main debtor and focused on the guarantor. They seized about 4,000 2 of land in Radhimë, Vlora. They threatened him through phone calls. They contacted his sister, son-in-law, daughter, wife, and extended family. They had extremely detailed information, even from the civil registry, including their workplaces and phone numbers. They sent letters to his workplace,’ says lawyer Sokol Kamberi, who is handling Lavdosh’s case.

‘I have the impression that they had detailed information and chose individuals who were easily intimidated and owned real estate. The bailiff provided the information on the properties because they had access to the State Cadastre Agency. And they exploited this access,’ he explains.

Lawyer Kamberi notes that the first cases of microcredit abuse he encountered were in 2019. He highlights that the most blatant cases are found in rural areas because the people there are more vulnerable. ‘They have extensively abused in rural areas, especially in cases where the ‘victims’ did not have legal assistance, either due to economic hardship or their social and cultural level,’ the lawyer stated.

Delayed Response from the Bank of Albania

The Bank of Albania has not officially provided the number of individuals affected by microcredit fraud schemes.

‘The case is under investigation by the prosecution authorities, and only upon the conclusion of the investigation and determination of guilt can concrete statistics for defrauded individuals be established,’ the Bank of Albania told Faktoje, noting that a new regulation on ‘Licensing and operation of activities by non-bank financial entities’ has been in force since June 5.

‘The liquidator has the right, after the revocation of the license and the start of liquidation, to create a detailed plan aimed at the best possible management of the credit portfolio of the non-bank financial entity. This plan will include several scenarios, depending on the specifics of the cases, which will outline the respective processes,’ the Bank of Albania stated.

The new provisions in the Bank of Albania’s regulation aim to facilitate and expedite the liquidation process and manage the portfolios of existing clients of these entities, especially in terms of their credit histories.

‘For this reason, a special working group has been established within the Bank of Albania to address all concerns raised by this category’,- the Bank emphasized.

However, experts believe the new regulation is both overdue and insufficient.

According to Zef Preçi, clients who are regular with their payments and continue to pay should be legally allowed to make their payments to another institution for their loan, while those facing difficulties should be encouraged to report their cases to the court.

‘Clients who have been unfairly penalized, whose property has been seized multiple times over the capital, should be regulated by law,’ said Preçi.

‘This is an issue where the Bank of Albania should be deeply involved to maintain the balance between the parties,’ he added.

In contrast, Professor Selami Xhepa does not see the solution in the courts. According to him, referring every issue to the court is an excuse to avoid addressing any problems.

‘There needs to be an agency dedicated to protecting consumers from financial products that are extremely complex and difficult to understand. Consequently, the system for resolving disputes should be more straightforward than going to court, he suggested.

Valbona Elezaj did not find the solution in the courts or institutions. To escape the ‘quick loan’ trap, the 40-year-old from Kukës ended up taking on another debt.

‘I had to borrow money from relatives to get out of this situation,’ she said, adding that she would not recommend anyone take out a quick loan. Nor would she suggest acting as a guarantor for someone else—be it a spouse or other family members. ‘The loan was granted to us in under an hour, but my heart knows the pain I endured until I was able to escape,’ she concluded.