Ahead of the elections, the government proposed to businesses the ‘Fiscal Peace’, a package that includes massive debt forgiveness and a review of tax obligations. Albanian businesses owe the state 1.6 billion euros. Experts say this is yet another electoral favor that undermines fiscal fairness and encourages informality.

Esmeralda Topi

At a meeting with businesses from Elbasan at the peak of the election campaign, Prime Minister Edi Rama unexpectedly announced a new initiative: ‘Fiscal Peace’ a relief package involving massive debt forgiveness and revision of tax obligations.

‘A fiscal peace plan, inspired by the principles of Ancient Rome’, Rama described this move just weeks before the elections. ‘We have designed a plan (…) that has been used occasionally in various forms, a fiscal peace plan’, he added.

The package is not part of the political program ‘Albania 2030‘ but the government argues that it will bring less stress to businesses, fewer inspections, and greater clarity.

The three main components of Fiscal Peace are:

- Agreed Profit Tax

- Review of Financial Statements

- Forgiveness of Liabilities and Late Payment Interest

The initiative foresees full cancellation of tax debts older than 10 years, if still unpaid. For debts aged 5 to 10 years, 50% forgiveness is offered if the business pays immediately. For businesses unable to pay immediately, there will be a 12-month agreement with 25% forgiveness. Social security obligations are excluded.

Additionally, the package proposes revising past profit tax declarations.

Businesses are given the right to revise tax declarations for the past 5 years without fines and interest on arrears (current law allows only 3 years), while paying a 5% profit tax on any profit difference resulting from the revision.

How much do businesses owe the state?

Albanian businesses owe the state 162.5 billion LEK, or approximately 1.6 billion euros, in unpaid taxes and customs duties.

Value Added Tax (VAT) and profit tax are the primary types of taxes that businesses have failed to pay over the years. Official data reveal that 84.7% of this debt is over two years old. While liabilities overdue for more than five years make up 64.4% of the total.

- 84.7% of the debt is older than two years.

- 64.4% dates back more than five years.

Over the past decade, the volume of unpaid business debt has increased year after year, 2017 being the only exception.

Former tax director Artur Papajani argues that debt cancellation is not a reward, but a form of punishment.

‘The mass cancellation of tax debts is not a privilege for those in debt! It is a punishment and a discouragement for the thousands of taxpayers who have consistently fulfilled their tax obligations’, Papajani told Faktoje.al.

Meanwhile, legal auditor Julian Saraçi calls the initiative a sign of the state’s capitulation to informality.

‘Fiscal peace is yet another repeated act of surrender to informality, which has been tolerated for years. This initiative is not a settlement—it’s a capitulation’.

If businesses have outstanding debts older than 10 years, it means the administration has failed to collect them in due time, Saraçi points out.

‘This is not merely a case of forgiveness, but also an institutional absolution of responsibility. That’s why, rather than a so-called peace, what’s truly needed is an in-depth investigation into why this debt was created, written off, and why no action was taken to recover it’.

The total business debt to the state would be even greater if successive governments hadn’t periodically approved fiscal amnesties, forgiving billions of Lek in business liabilities.

Pre-election fiscal giveaways

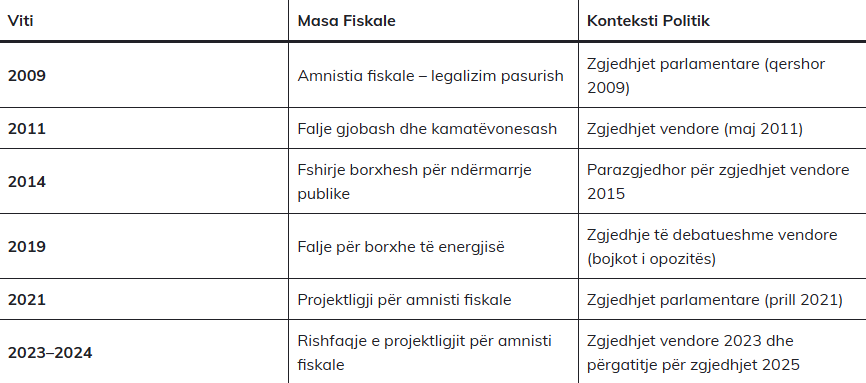

This is not the first time that debts have been pardoned during pre-election periods. Since 2009, at least six measures with an amnesty character have been implemented, aligning with local or parliamentary elections.

Source: ALTAX Center

In 2009, as Albanians were preparing to vote in the general parliamentary elections, the government of the time introduced a proposal to legalize undeclared capital. Between 2011 and 2014, old fines and obligations were pardoned, followed in 2019 by the cancellation of energy-related debts. Similarly, in 2023–2024, the government revived the draft law on fiscal amnesty, despite clear opposition from all major international institutions, including the IMF, the World Bank, and the European Union.

‘This is not a coincidence, but a repeated electoral tactic where the state uses fiscal policy to purchase compliance instead of cultivating fiscal discipline’, says ALTAX.

Experts from the ALTAX Center emphasize that this approach must be halted immediately, warning that the consequences will be serious.

‘Informality will rise because taxpayers may opt to delay payments, anticipating ‘another round of forgiveness.’ At the same time, fiscal equity will be undermined, since a state that pardons selectively can never be truly fair. Clientelism will also deepen, as fiscal pardons repeatedly occur on the eve of elections’, – ALTAX.

Is this genuine fiscal peace, or merely a pre-election favor that fosters injustice and puts law-abiding businesses at a disadvantage? That’s the question being asked now, as legislation becomes more lenient during the campaign period.