The removal of VAT on basic food items was the cornerstone of the Socialist Party’s electoral campaign in 2013. The promise, once grand, has remained unfulfilled for a decade, while Albanians bear the burden of the highest food prices in Europe. Faktoje verified the impact of breaking this promise on household budgets. Meet the story of a pensioner who receives 10,000 Lek per month and pays more for basic groceries than in Italy, where the monthly pension is ten times higher.

Albina Hoxhaj

‘We will no longer require the typical families of this country to pay a 20% tax on a kilogram of bread, a 20% tax on a kilogram of milk, a 20% tax on an egg, or on oil, flour, or rice.’ ‘We will make food taxes zero for the people,’ stated Edi Rama, Chairman of SP, and at that time, candidate for Prime Minister, during the 2013 electoral campaign.

During his discussions with citizens while presenting the SP electoral program, Rama pledged to be held accountable if he did not fulfill this promise within 4 years.

Albania should have had zero food tax at least since 2017.

1 decade after the promise

Agim Rrëshiti moved from Përmet to Tirana in 2008. Agim receives a pension of 10,700 new LEK and finds the cost of living in the capital unaffordable.

‘I spend 10,000 old LEK on blood pressure medication.’ Food is very expensive. With the pension, I can only afford to pay for electricity and water. We buy oil, pasta, beans, a bottle of milk every 2 days, coffee, and sugar. Two slices of meat cost 13,000 old LEK, which we rarely buy. Without the help of my children, I would not be able to live. ‘The pension is not enough for food!’ he tells to Faktoje adding:

‘It’s been a while since the shower has been broken and it costs 150,000 old LEK’ he says, noting that he can’t afford it. I get showered with a bucket like in the old days.

Agim’s sons have chosen not to emigrate. On one hand, the elderly man feels comforted by their presence, but on the other hand, he worries about their future when he sees prices rising and becoming increasingly unaffordable.

‘If food were more affordable, we would have the opportunity to buy more. I’m almost done now, yet my children still struggle to settle down and build their families due to low incomes.’

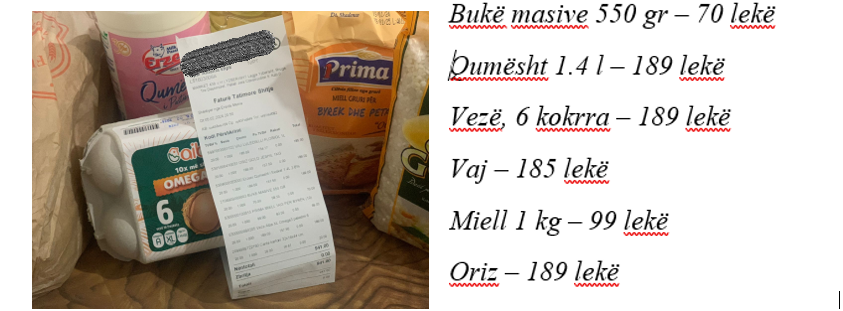

For just six food products, Agim needs to spend a tenth of his pension (941 LEK). If VAT were zeroed out, he would pay around 780 LEK. (Which is still expensive given his pension.)

The bill for 6 items purchased at a supermarket in Tirana (Total 941 LEK)

Meanwhile, ironically, in Imola (a region near Bologna) in Italy where the average pension varies between 800 – 1100 Euros, the same products cost less than in Tirana.

The purchase of six products in Italy amounted to 8.29 Euros (equivalent to 865 LEK). Moreover, VAT on food products in Italy ranges from 4-5%.

6 items bought at a supermarket in Italy (Total 8.29 Euro or 865 LEK)

Propaganda with food VAT

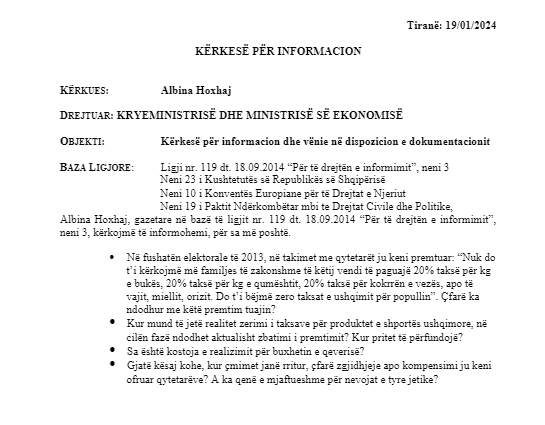

Faktoje addressed a request for information to the Council of Ministers, the Prime Minister, and the Ministry of Finance on January 19, inquiring whether any action had been taken to fulfill the most ambitious promise of 2013.

| Tirana, 19/01/2024

REQUEST FOR INFORMATION INQUIRER: Albina Hoxhaj TO: PRIME MINSTER’S OFFICE AND MINISTRY OF ECONOMY SUBJECT: Request for information and provision of documents LEGAL BASIS: Law No. 119 dated 18.09.2014 ‘On the right to information’, Article 3 Article 23 of the Constitution of the Republic of Albania and Article 10 of the European Convention on Human Rights Article 19 of the International Covenant on Civil and Political Rights, Albina Hoxhaj, Journalist, in accordance with Law No. 119 dated 18.09.2014 ‘On the right to information,’ Article 3, requests to be informed as follows: • During the 2013 electoral campaign, in meetings with citizens, you promised: ‘We will not ask typical families of this country to pay a 20% tax per kg of bread, 20% tax per kg of milk, 20% tax per egg, or on oil, flour, rice.’ We will reduce food taxes to zero for the people.’ What happened to this promise of yours? • When might the zero-rating of taxes on food basket products become a reality, and in what stage is the implementation of the promise currently? When is it expected to finish? What is the cost of implementation for the government budget? During this period of price increases, what solutions or compensation have you offered to the citizens? Has it been enough to meet their essential needs? |

Requests for information addressed to institutions

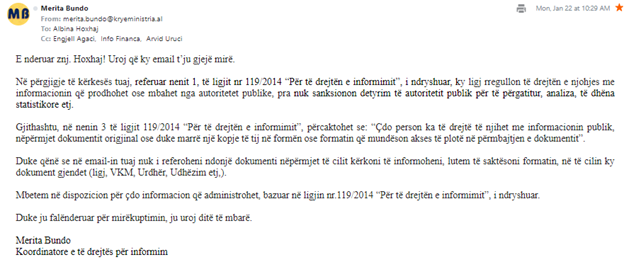

Prime Minister’s Press Office gave us a response that was already a well-known excuse for avoiding accountability.

‘Since your email does not refer to any specific document through which you are seeking information, please specify the format in which this document can be found’.

| MB

Merita Bundo From: merita.bundo.kryeministria.al # Mon Jan 22 at 10:29 AM *

Dear Mrs. Hoxhaj! I hope this email finds you well. In response to your inquiry, as stipulated in Article 1 of Law No. 119/2014 ‘On the Right to Information,’ this law governs the right to access information produced or held by public authorities, and does not impose any obligation on public authorities to prepare, analyze, provide statistical data, etc. Additionally, Article 3 of Law No. 119/2014 ‘On the Right to Information’ stipulates: ‘Every individual has the right to be informed of public information, either through the original document or by obtaining a copy thereof in a form or format that enables full access to the document’s content.’ ‘Since your email does not refer to any specific document through which you are seeking information, please specify the format in which this document can be found (Law, DCM, Order, Instruction etc. I am available to provide any information under my administration, in accordance with Law No. 119/2014 ‘On the Right to Information,’ as amended. Thank you for your understanding, and I wish you a great day. Merita Bundo Coordinator of the Right to Information |

Reply from the Right to Information Coordinator at the Office of the Prime Minister

To ensure an exhausting response, we followed the logic of how an electoral promise is fulfilled.

The program with which the political force came to power should have been analyzed by experts, and its implementation should have been carried out year after year. How would VAT removal on basket food products be achieved?

The relevant Ministry, in collaboration with the Ministry of Finance, develops a draft proposal, which is then submitted to the Council of Ministers. The draft is discussed, goes through parliamentary committees, and is ultimately voted on in Parliament before being implemented.

The Economic Expert and Former Minister, Zef Preçi, explains that none of these steps have taken place.

‘There is a lack of data on the poverty level. Experts were to conduct a thorough analysis, following which two ministries would propose a draft to the government for the removal of VAT. This draft would be discussed and subsequently presented to Parliament. This would pave the way for the removal or reduction of the 20% VAT,’ argues Preçi.

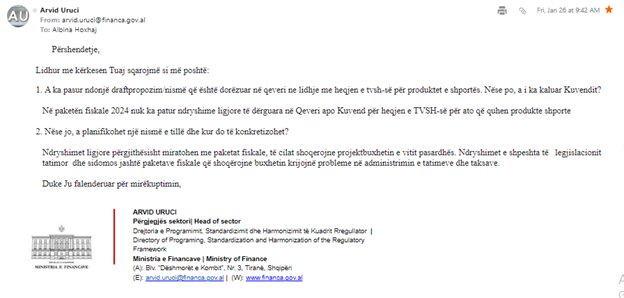

Faktoje once again addressed the Prime Minister’s Office and the Ministry of Finance, this time requesting in the correct format whether there is a draft proposal for the initiative to remove VAT on food, and if not, when such a plan is scheduled to be developed. In the official response from the Ministry of Finance, it is emphasized, among other things:

‘In the 2024 fiscal package, there have been no legislative amendments sent to the Government or Parliament for the removal of VAT on what are called basket products. Legislative amendments are typically approved within fiscal packages that accompany the draft budget for the subsequent year. Frequent changes to tax legislation, particularly outside of the fiscal packages accompanying the budget, pose challenges in tax and revenue administration.’

| Hello,

With regard to your request, we clarify as follows:

Has there been any draft proposal or initiative submitted to the government regarding the removal of VAT on basked products? If so, has it been presented to the parliament?

In the 2024 fiscal package, there have been no legislative amendments sent to the Government or Parliament for the removal of VAT on what are called basket products.

2. If not, is there a plan to introduce such an initiative, and when can we expect it to be finalized?

Legislative amendments are typically approved within fiscal packages that accompany the draft budget for the subsequent year. Frequent changes to tax legislation, particularly outside of the fiscal packages accompanying the budget, pose challenges in tax and revenue administration.

Thank you for your understanding,

Arvid Uruci Head of Sector

|

Response of Ministry of Finance

We live to eat, and yet it’s never enough!

As an expert in Economic natters, Pano Soko assesses how a 20% reduction in VAT impacts citizens with moderate and low incomes.

‘The 20% tax on products for families with medium and low incomes accounts for 1/5 of their expenditures per purchase, and this category spends nearly 100% of their income on food.’

The post-pandemic price increases have left citizens unable to secure even the basic food items for their tables.

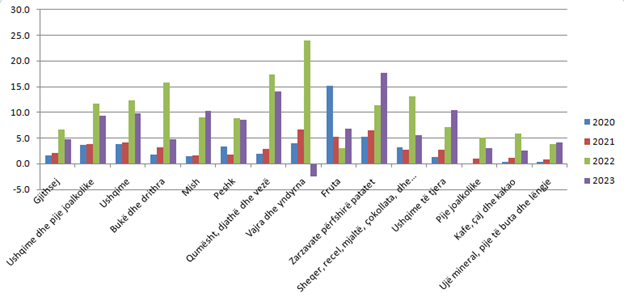

According to INSTAT, the Consumer Price Index in December 2023 reached 115.8 compared to December 2020, meaning that the average annual price increase in 2023 was 4.8%, compared to 6.7% the previous year.

Source, INSTAT

According to Soko, the main reason for this burden, which predominantly falls on needy families, is the considerable difficulty institutions encounter in tax collection. Fulfilling the electoral promise of zeroing VAT would require approximately 100 million Euro from the state budget.

‘It’s not applied in Albania due to negligence. There hasn’t been a precise calculation to understand the cost to Albanians, but it could be around 100 million Euros for essential consumer goods. We’re not efficient in tax collection; our institutions struggle in this regard. Without these consumption taxes, such as the basic VAT, fuel taxes, or cigarette excise taxes, among others, meeting the necessary budget to fulfill the obligations of the Albanian state would be extremely challenging‘, says Soko.

In the absence of zero-rating VAT, economic expert Klodian Muço suggests:

‘Differentiating VAT for consumer basket products in our country would be beneficial if control mechanisms by public institutions were effective.’ This way, the price reduction resulting from VAT reduction would benefit consumers directly, rather than staying in the pockets of traders, as has happened when VAT was removed from educational services or reduced in hotels. These types of policies are implemented during certain moments of crises or high inflation.

According to him, this enforcement policy should be temporary for two reasons.

‘Firstly, private savings (bank deposits) have increased. During the pandemic, savings increased, and given the global rise in prices due to inflation, the best way to support consumption is by reducing VAT and curbing saving. Secondly, Albania has a high VAT evasion rate; differentiating and reducing it for food products would help honest traders as they would sell more,’ Muço explains.

The only initiative for reducing VAT was rejected in 2022

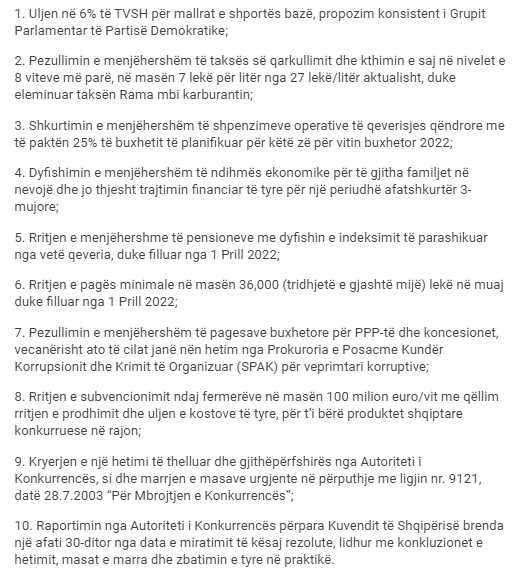

With the utopian promise of the majority failing after taking office, the opposition presented the initiative in 2022 to reduce VAT to 6% for basket foods. Presented in the form of a 10-point draft, the Democratic Party (DP) requested approval from the Parliament, but the initiative was rejected with opposing votes from the parliamentary majority on March 24 of that year.

| 1. Reducing VAT to 6% for basic basket products, a consistent proposal from the Parliamentary Group of the Democratic Party;

2. Immediate suspension of the circulation tax and reverting it to the levels of 8 years ago, at 7 LEK per liter from the current 27 LEK/liter, thus eliminating Rama’s tax on fuel; 3. Immediate reduction of central government operational expenses by at least 25% of the budget allocated for this item for the fiscal year 2022; 4. Immediate doubling of economic assistance for all needy families, rather than simply providing short-term financial support for a 3-month period; 5. Immediate doubling of pensions beyond the indexing envisaged by the government itself, starting from April 1, 2022; 6. Increasing the minimum wage to 36,000 (thirty-six thousand) LEK per month starting from April 1, 2022; 7. Immediate suspension of budgetary payments for public-private partnerships (PPPs) and concessions, especially those under investigation by the Special Prosecution Office against Corruption and Organized Crime (SPAK) for corrupt activities; 8. Increasing the subsidy to farmers to 100 million Euro per year with the aim of boosting production and reducing their costs, making Albanian products more competitive in the region; 9. Conducting a comprehensive and thorough investigation by the Competition Authority, and taking urgent measures in accordance with Law No. 9121, dated July 28, 2003, ‘On the Protection of Competition’; 10. Requiring a report from the Competition Authority to the Albanian Parliament within 30 days of the adoption of this resolution, regarding the investigation findings, the measures taken, and their implementation in practice. |

The draft with 10 points deposited in Parliament in 2022, for reducing VAT on food

INSTAT: 39% of income is spent on food.

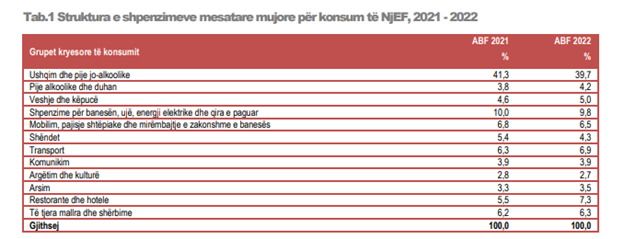

INSTAT Report for 2022 on food expenditure reveals that families spend 39.7% of their income, nearly half of their earnings, which have increased by 0.3% from the previous year.

Europe spent an average of 13.6% of its total budget on food, almost three times less than Albania.

Source: INSTAT

Since 1996, when Albania began implementing VAT, the rate has remained unchanged at the same level of 20%. In neighboring countries in the Western Balkans, as well as in EU member states, reduced or temporary rates are applied to alleviate the burden on citizens. The average VAT for food products is 9%. Albania does not apply a reduced VAT rate for food and basket products, making it the country with the highest VAT rate for these products in Europe and the Western Balkans.

Meanwhile, Serbia applies a 10% tax on basic goods, Kosovo 8%, Montenegro 7%, and North Macedonia 5%. Even Bosnia and Herzegovina, which does not apply a reduced rate, has a lower tax burden, as the standard rate is 17%, still lower than that of Albania.

‘Other countries are not institutionally weaker and for this reason, have decided to reduce VAT and shift the tax burden from consumption in poor families to capital. Countries do so when they develop. We have not yet developed; we are not at the level of other countries in the region, because even countries in the region have escalated VAT,’ – Soko explains for Faktoje the reasons why other countries apply a reduced tax compared to Albania.

Conclusion

Based on the verification conducted and the information gathered, we decided to categorize the promise of the 2013 campaign to zeroing the VAT on basic food as an Unfulfilled Promise.

*This writing is part of the call for the national fact-checking writing competition

The first prize will be awarded the ‘Fatos Baxhaku’ prize.