Pre-electoral mistake or deliberate deception? That’s the question raised after Faktoje verified a statement made by Minister of Finance, Delina Ibrahimaj, on the eve of local elections. As the custodian of the country’s budget, the minister presented inflated figures for value-added tax (VAT) revenues, directly related to the country’s consumption and economic activity. According to her, VAT revenues in the first three months of this year increased by 16.7% compared to the same period the previous year. However, the truth is that the increase in this figure was only 0.6%.

Esmeralda Topi

“…the revenues have increased by 16.7% for the value-added tax, a figure that we primarily analyze to understand and assess the first-quarter economic performance since it is directly linked to economic activity and consumption.”, declared Finance Minister Delina Ibrahimaj During a press conference on May 2nd, dedicated to the performance of key economic indicators for the first quarter.

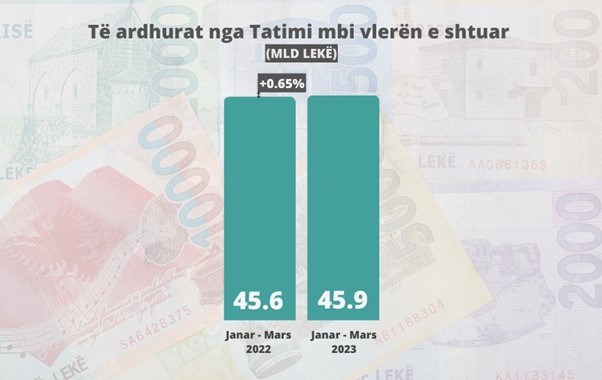

Faktoje’s fact-checking reveals that this statement is untrue. Official data published by the Ministry of Finance shows that VAT revenues in the period January-March of this year amounted to 45.9 billion lekë. In the same period a year earlier, the state treasury collected 45.6 billion lekë as VAT revenues.

Source: Ministry of Finances

The calculations clearly show that the increase in this figure was only 0.6%, not 16.7% as claimed by Ibrahimaj. VAT is a tax that tracks the circulation of goods in the economy, charged based on their selling price.

The minister’s presentation of inflated VAT revenue figures, closely tied to the country’s consumption and economic activity, raises questions about whether it was merely a coincidence or a deliberate move, considering it occurred just days before the local elections on May 14th.

Propaganda or a gaffe?

Faktoje has sought an explanation from the Ministry of Finance regarding Minister Ibrahimaj’s statement but, as of the publication of this article, no response has been received.

Regardless of whether it was a blunder or a calculated propaganda statement, economic experts find it unacceptable when such statements are publicly articulated by the head of a country’s public finance.

“The minister might have compared it to the year 2013!” quips Professor Selami Xhepa, adding that the minister’s statement appears to have propaganda purposes.

“”The data shows that total revenues in the first quarter of 2023 increased by 11.9% compared to the same period in 2022, while VAT revenues increased by only 0.6%! What the ministry is stating is a deceptive statistic with only propaganda purposes…,” Xhepa points out to Faktoje.

VAT still the same!

According to previous data from the Ministry of Finance, during the period of Janar-Maj, the state treasury collected 257.8 billion lekë in total revenues, compared to 233.4 billion collected in the same period the previous year.

Preliminary indicators suggest that the increase in revenues was primarily led by profit tax and personal income tax.

However, VAT revenues, which serve as a key indicator of consumption performance in the country, reflect a different situation.

According to the tax table, VAT revenues in the first five months of the year increased by only 886 million lekë or 1.2% compared to the same period last year. Meanwhile, in real terms, VAT revenues show a decline compared to a year ago, as the average inflation for the first five months of the year was 5.8% on an annual basis.

*VAT – is a general tax on the consumption of goods and services, proportional to their price, imposed at every stage of production and price distribution process without tax deduction. VAT is applied as a percentage tax on the price of goods and services and becomes payable after deducting the VAT that directly burdens the elements of the cost of goods and services.