Prime Minister Edi Rama has stated that pensions have gone up by 8.2% compared to 2013. Based on the data by INSTAT, this statement is true. The average urban pension has increased by 2.178 ALL per month and the average rural pension has increased by 1700 ALL per month. The data shows that the increase of urban pensions has been above the inflation rate (1.77%), but not as much as twice the inflation rate, while in rural areas this increase turns out to be twice as much as the inflation rate.

Through a post in March 2017, Prime Minister Rama stated:

“Thanks to state formation reforms currently all grandparents, living in both urban and rural areas will receive a 8.2% higher pension than in 2013. Much more remains to be done and it will be done by all means”

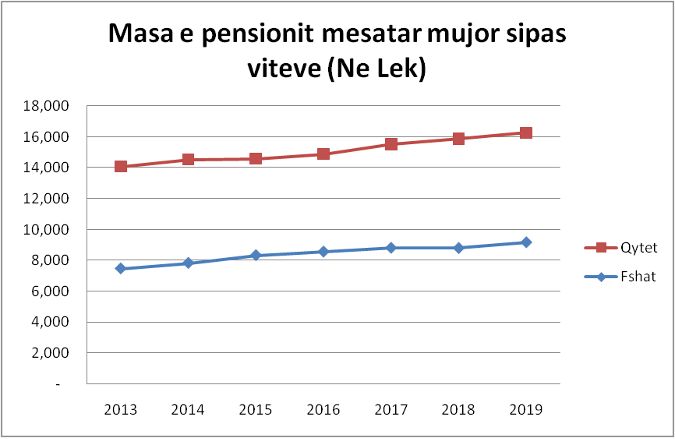

According to the data by INSTAT, the average monthly urban pension has increased from 14,076 ALL per month in 2013 to 15,527 ALL per month in 2017, or an increase of approximately 10%. Meanwhile, the average monthly rural pension has increased from 7.465 ALL per month in 2013 to 8,808 ALL per month in 2017, or an increase of approximately 18%.

Based on INSTAT data, Prime Minister Edi Rama’s statements turn out to be true.

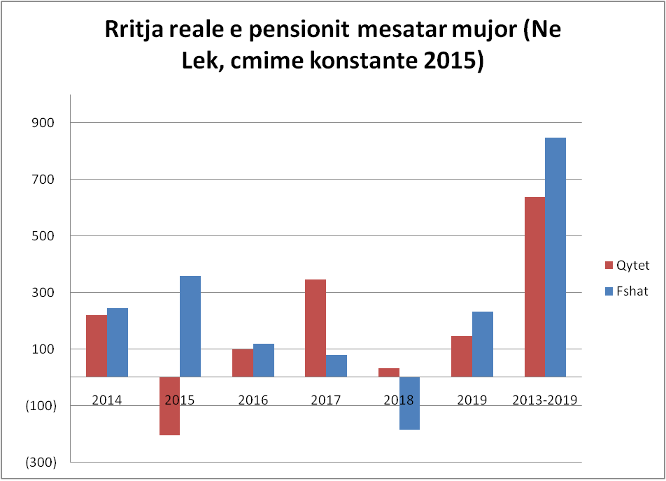

But we have analyzed the increase of pensions not only by nominal value, but also by real value (purchasing power), from 2013 to 2019.

According to the data by INSTAT, the average monthly urban pension has increased by 14,076 ALL per month in 2013 to 16,254 ALL per month in 2019. Meanwhile, the average monthly rural pension has increased from 7,465 ALL per month in 2013 to 9,165 ALL per month in 2019.

Urban Pension – Nominal Growth

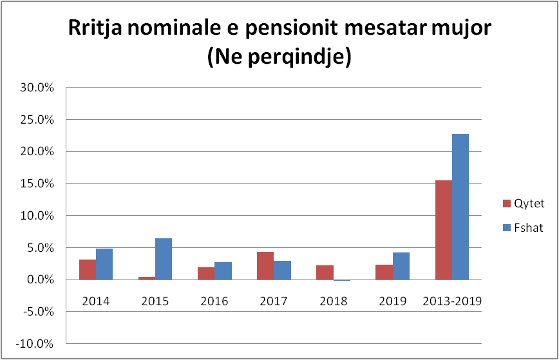

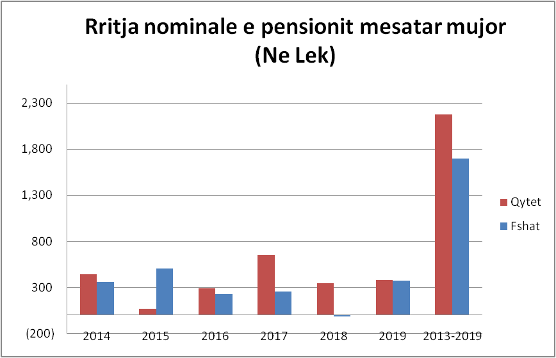

During the last 6 years, as we will explain below, the average monthly urban pension has increased by 2,178 ALL, or 15.5%. The urban monthly pension has increased on average by 363 ALL from year to year, or an increase once a year by an average of 2.4% each year.

So, the income of a pensioner in urban areas has increased by an average of 4,356 ALL from year to year. In all 6 years, the total supplement that has been benefited from the increase in pensions is reckoned to have a total value of 86,122 ALL.

Rural Pension – Nominal Growth

As can be seen from the two graphs below, the average rural monthly pension has increased by 1,700 ALL, or 22.8%, during the 6-year period. The rural monthly pension has increased on average by 283 ALL from year to year, or an annual increase by an average of 3.5% each year.

So, the income of a pensioner in rural areas has increased by an average of 3,400 ALL from year to year. In all 6 years, the total supplement that has been benefited from the increase in pensions is reckoned to have a total value of 80,232 ALL.

But on the other hand, prices have gone up from year to year, a phenomenon otherwise known as price inflation. Thus, with yesterday’s money, you can buy less today. Considering the annual increase of prices or inflation, we have calculated the real increase of pensions from 2013 to 2019, using the constant prices of 2015.

Have the pensions increased more or less than the prices during this period? Can pensioners afford more products and services?

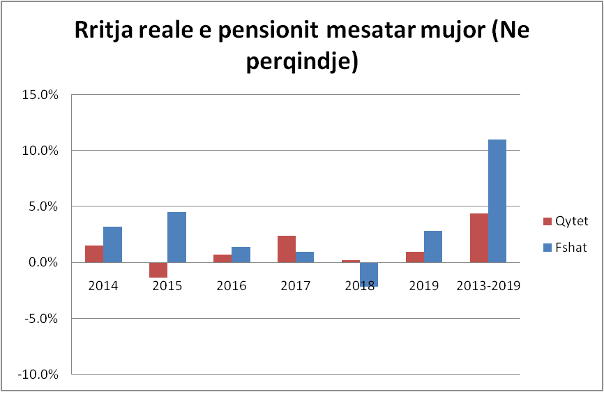

Urban Pension – Real Growth

From the graphic illustration below, it is shown that the average urban monthly pension has increased realistically (stripped of compensation for price increases) by 638 ALL, or 4.4%, during the 6-year period. The urban monthly pension has increased on average by 106 ALL from year to year, or a real increase once a year by an average of 0.72% each year.

For a year, urban pensions have increased income realistically (meaning what more can they buy according to the 2015 pricing) with an average of 1,275 ALL from year to year. In all 6 years, the total supplement that has been benefited (what more they can buy according to the 2015 pricing) from the increase in pensions is reckoned to have a total value of 23,283 ALL. So, with all the supplements from the pension during 6 years, he can buy an additional mobile phone with the price of 23,283 ALL in 2015.

Rural Pension – Real Growth

From the graphic illustration below, it is shown that the average rural monthly pension in rural areas has increased realistically (stripped of compensation for price increases) by 848 ALL, or 11%, during the 6-year period. The rural monthly pension has increased on average by 141 ALL from year to year, or an increase once a year by an average of 1.77% each year.

For a year, rural pensions have increased income realistically (meaning what more can they buy according to the 2015 pricing) with an average of 1,696 ALL from year to year. In all 6 years, the total supplement that has been benefited (what more they can buy according to the 2015 pricing) from the increase in pensions is reckoned to have a total value of 45,969 ALL. So, with all the supplements from the pension during 6 years, he can buy an additional mobile phone with the price of 45,969 ALL in 2015.

From this analysis we understand that the increase of urban pensions has been on average above the inflation rate (average inflation 1.7%) during these years, but not as much as twice the inflation rate. The average nominal growth was 2.4% per year. The average real pension growth was 0.72% per year. While the average real growth of the economy during the years 2014-2019 has been on average 2.9%.

The increase of rural pensions has been on average above the inflation rate (average inflation rate 1.7%) during these years, but not as much as twice the inflation rate. The average nominal growth was 3.5% per year. The average real pension growth was 1.77% per year. While the average real growth of the economy during the years 2014-2019 has been on average 2.9%.