The Democratic Party has undertaken to increase pensions each year at twice the inflation rate or, in other words, no less than 5% per year. The cumulative amount for four years is estimated to be 30 billion ALL or 250 million Euros. According to economy experts, this promise appears to be real and meets the IMF’s forecasts, if it were to be considered separately from the other promise of the DP’s leader Mr. Basha concerning the reduction of social security contributions from 24.5% to 18% of the salary. Another element that may negatively affect the fulfillment of the promise to increase pensions are the economic and social consequences of the earthquake of November 26, 2019, and the Covid-19 pandemic.

During the introduction of the DP’s electoral program for the elections of April 25, Basha stated:

“I hereby undertake to increase pensions by at least twice the inflation rate and, at any case, by no less than 5% per year, in order for the average Albanian pensions to be higher than the average pensions of the region by the end of our first term.”

What is the financial cost to the State Budget for the fulfillment of this promise?

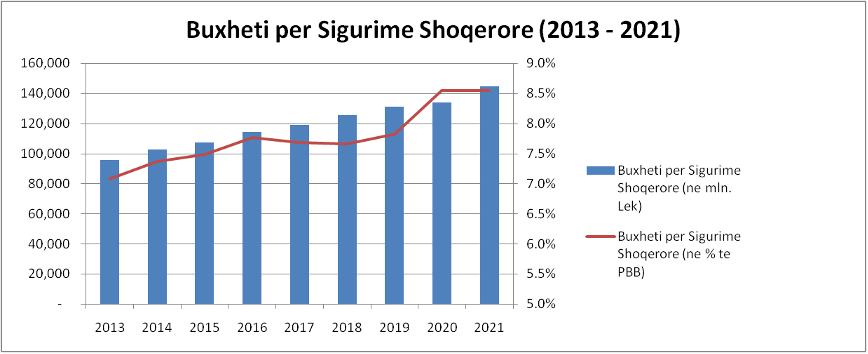

In the recent years, the budgetary item for pensions constitutes approximately 7.7 % of the GDP. In the 2020-2021 period, this amounts to 8.5% of the GDP as a result of the crisis and new policies on pensions envisaged for 2021 by the current government.

Below we have presented the progress of the State Budget’s Pension Fund for 2013-2021, according to the data by the IMF and the Ministry of Finance.

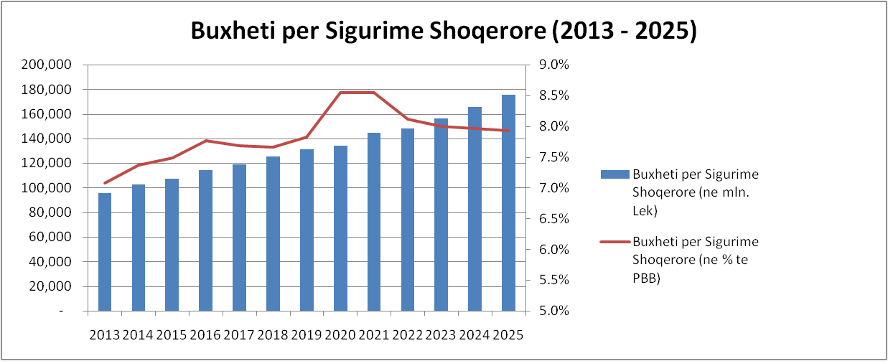

Based on the IMF’s forecasts about the inflation in Albania for 2021-2025, we have estimated the pension increase per year that will apply according to the DP’s promise.

The nominal pension increase according to the DP’s promise will be 5-6% per year, thus higher than the average nominal increase of urban and rural pensions during 2013-2019. Additionally, the real average pension increase will amount to 2.74% per year on average during the 2022-2025 period, thus being higher than the average nominal increase of urban and rural pensions during 2013 -2019.

In order to analyze the promise’s costs to the budget in monetary value (because, with the real and nominal economic increase, part of the cost becomes more affordable), we will use the data from the IMF’s inflation and GDP forecasts for the upcoming years.

We have analyzed the same for the economic model of the DP, estimating a real increase of 5.5% and deflator of 2.5%. Obviously, this takes into consideration the fact that the necessary scheme reforms will continue, the number of pensioners included in the scheme will be similar, and that the demographic issues that affect the scheme will be managed.

Based on the calculations in the table above, taking into consideration that the first increase will take place in mid-2022, the budgetary financial impact in the first year will be around 30 million Euros, and will increase to approximately 80 million Euros by 2025. The cumulative amount for four years is estimated to be 30 billion ALL or 250 million Euros.

However, how affordable is this increase if we consider the economic progress according to the IMF and the DP? Does it affect the fiscal parameters?

As evidenced in the following chart, according to the promises of the DP and the forecast of the IMF about the economy, the pensions’ weight on the budget by the end of 2025 is 7.9% of the GDP (7.6% of the GDP according to the economic forecasts of the DP). In other words, it is at the same level as in 2019.

Clearly, the above does not take into consideration other current issues that may expose the scheme during these years, such as the economic damage due to the pandemic, the reconstruction, but also the promise of Mr. Basha regarding the reduction of social security contributions from 24.5% to 18% of the salary, which would affect the deficit of the pension scheme and the State Budget, another significant indicator of the pension scheme’s sustainability.